Uncover Australia’s Regulatory Outlook for 2023

Discover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowThe Australian Federal Police has announced it recorded a spike in online financial sextortion reports over the Christmas/Summer 2022 school holiday period. According to the AFP-led Australian Centre to Counter Child Exploitation (ACCCE), reports from December alone increased by almost 60%, with more than 90% of victim reports coming from teenage boys.

Despite the sharp increase in reports, the police suspect the scale of online child sexual exploitation far outweighs what is being reported. Acting Assistant Commissioner Hilda Sirec said, “We are seeing offshore criminal syndicates targeting a victim’s entire friend list.”

In December 2022, the Australian Transaction Reports and Analysis Centre (AUSTRAC) announced its partnership with the AFP to educate financial institutions to recognize risk indicators associated with purchasing child sexual exploitation material.

As a result of the partnership, the regulator issued a financial crime guide highlighting risk indicators according to different types of exploitation. Some risk indicators include:

While no single financial indicator will reveal if an account is being used for child sexual exploitation purposes, firms should consider each transaction’s relevant facts and circumstances in line with a risk-based approach to compliance.

According to AUSTRAC, payments for child sexual exploitation can be difficult to detect because offenders take considered steps to hide their crimes from friends, family, financial institutions, and law enforcement. As a result, offenders generally utilize websites and online services that offer increased privacy or encryption tools, virtual private network services, software to clear online footprints, or other tools or services for online privacy and anonymity.

New and emerging technologies are also being taken advantage of, such as blockchain technology. In light of this, firms should consider implementing blockchain analysis technology into their anti-money laundering and counter-terrorism financing (AML/CTF) programs, enabling them to assess risk and identify illicit activity proactively.

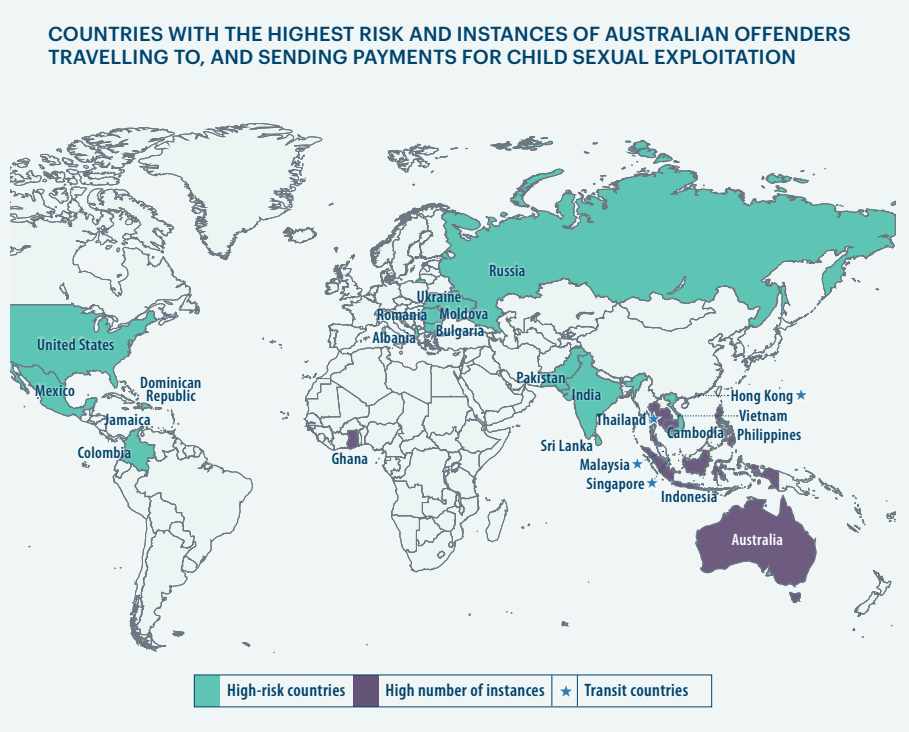

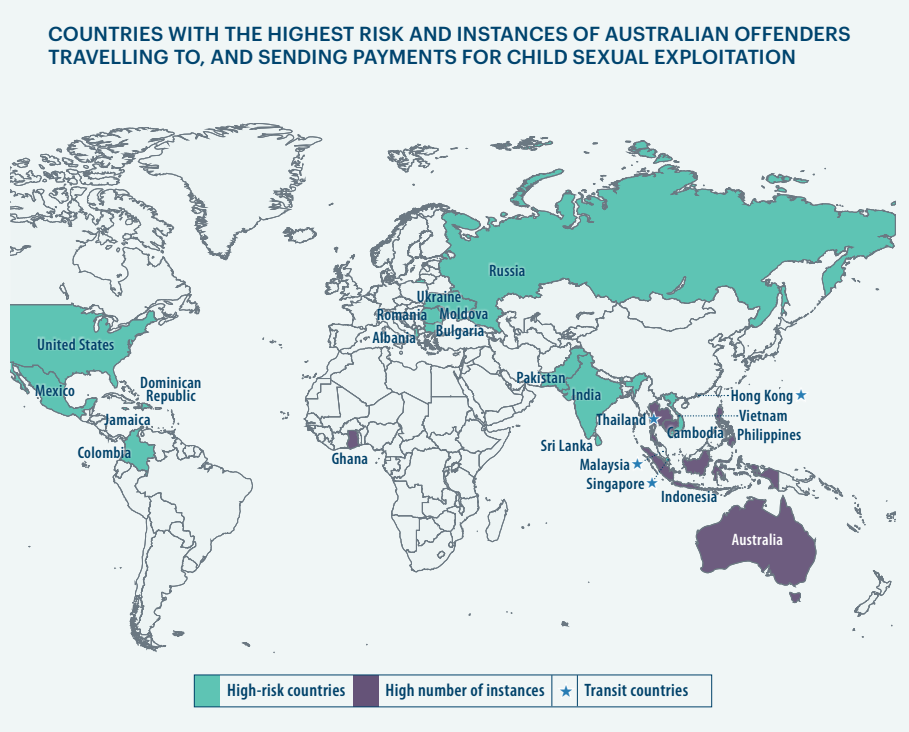

According to the report, common transit countries for Australian offenders may include:

The Philippines has also traditionally been the primary country for Australian offenders to visit and source child sexual exploitation material.

Compliance staff reviewing suspicious transaction details should be careful to note payment patterns that link to any of the above high-risk jurisdictions. To aid the reviewal process, AUSTRAC notes that payment amounts linked to child sexual exploitation are often rounded in the native currency of the high-risk jurisdiction or offender’s country. Further, when offenders travel to other countries to engage in child sexual exploitation activity, the regulator highlights that the frequency of transactions often escalates before travel-related expenses are purchased.

Source: AUSTRAC

In light of the guide provided by AUSTRAC, financial service providers should use the indicators and behaviors to review their profiling and transaction monitoring programs, recalibrating where necessary to identify and stop transactions associated with child sexual exploitation.

Compliance staff should also ensure they are up-to-date on reporting obligations regarding possible child sexual exploitation, abuse, or other criminal activity through financial transactions. If a firm determines a suspicious matter report (SMR) should be submitted to AUSTRAC, the report should include clear transactional, behavioral, and non-financial indicators.

For more information, firms should review the available resources provided by AUSTRAC regarding effective suspicious matter reporting.

Discover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowOriginally published 02 February 2023, updated 03 February 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).