A Spotlight on Financial Crime

Stay on top of regional trends and novel criminal techniques so you can protect your business from financial crime.

Download Our Free Global Compliance ReportWithout a doubt, the biggest story of 2022 centered around Russia’s invasion of Ukraine. As a result, record global sanctions made headlines, with the UN becoming sidelined as a major sanctions power. Away from the war, we saw a number of notable firsts, from cement companies supporting terrorist organizations to money laundering social media influencers.

As compliance professionals gear up for another year of unique challenges in an ever-changing regulatory landscape, we take a deeper look at some of the key financial crime moments from 2022 and consider their impact on 2023 and beyond.

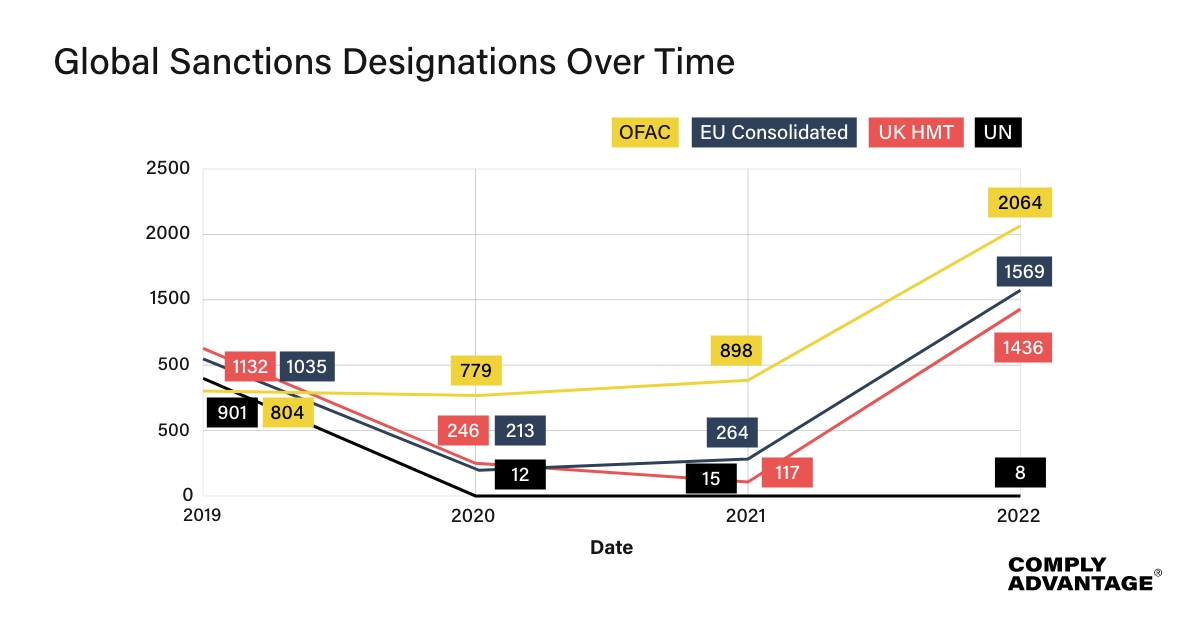

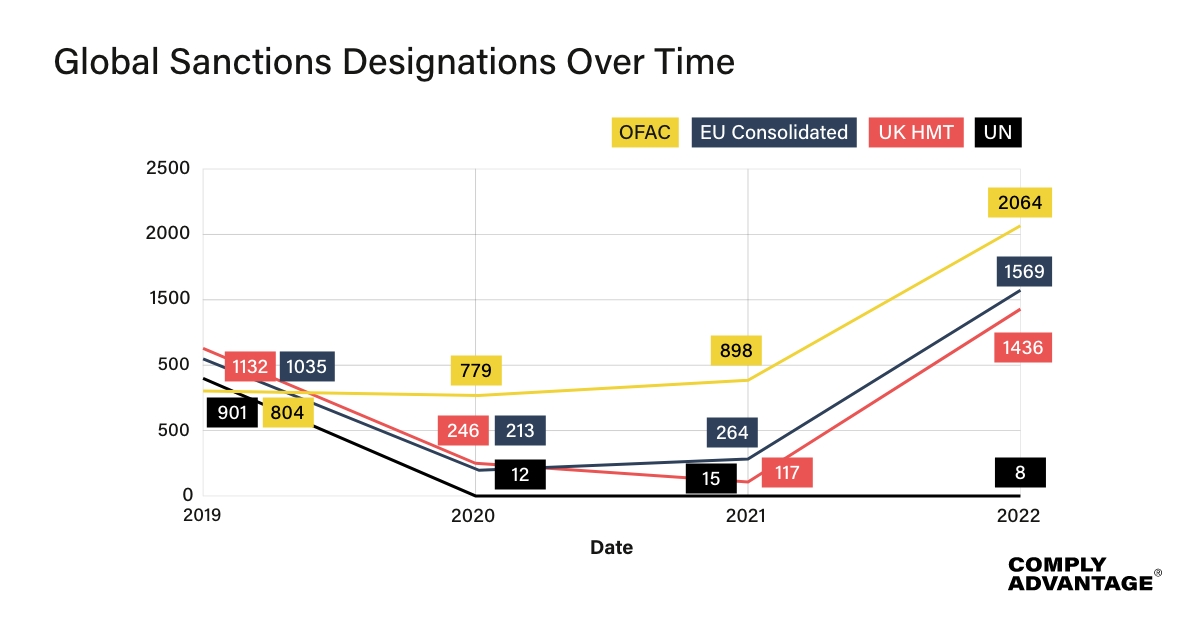

As of November 30, 12,902 restrictions had been imposed on Russia, with over 10,000 being issued after February 22 – two days before Russia’s invasion of Ukraine. Following the invasion, record global sanctions were reached in 2022, with the US, EU, and the UK becoming the dominant actors in the space. The UN, however, became sidelined as a major sanctions power on this issue, as Russia and China persistently attempted to veto any new measures.

While countries such as Turkey and the United Arab Emirates have historically replicated EU sanctions, this year saw them not follow suit in issuing Russian designations. Turkish President Tayyip Erdogan said in March this was because “We are buying nearly half of the natural gas we use from Russia. […] I can’t leave my people in the cold of the winter. Secondly, I cannot halt our industry.”

In July, a diplomatic adviser to UAE President Sheikh Mohammed bin Zayed al-Nahyan defended the country’s stance on Russian individuals, saying the UAE did not want to “lump together” all Russians into one category as some seek safe havens amid the Ukraine war. According to Reuters, the UAE’s position on Russian sanctions frustrated many Western diplomats who viewed the country’s stance as “untenable and siding with Moscow.”

As governments roll out support programs to help deal with the energy crisis, our Regulatory Affairs Specialists posit we are likely to see heightened fraud risks, as we did around COVID stimulus programs. In October, the UK’s national reporting center for fraud and cybercrime, Action Fraud, said nearly 1,600 reports had already been made to the National Fraud Intelligence Bureau about scam emails purporting to be about energy rebates from Ofgem.

In October, Lafarge SA, a French cement company, was fined $777.8m for payments to ISIS and another regional terrorist group to keep its plant operating in Syria. Between 2012 to 2014, over $10 million in payments were made to ISIS while the terror group kidnapped and killed people.

According to court documents, company executives purchased raw materials needed to manufacture cement from ISIS-controlled suppliers. Monthly “donations” were also paid to armed groups so that employees, customers, and suppliers could pass through checkpoints controlled by the armed groups on roads around the Syrian cement plant. Lafarge also agreed to make payments to ISIS based on the volume of cement it sold to its customers, which Lafarge likened to paying “taxes.”

Commenting on the fine, Iain Armstrong, Regulatory Affairs Specialist at ComplyAdvantage, said, “This is a first in more ways than one. Not only is it by far the largest fine ever issued for a terrorism-related offense, but it was also the US Justice Department’s first prosecution under the “conspiring to provide material support for terrorism” offense for corporate entities. Finally, it is the subject of a domestic French investigation that is likely to lead to the first trial in France for a company charged with complicity in crimes against humanity.

“It signals a doubling-down of the Justice Department’s stance on corporate misconduct. Through a suite of policy reforms, the DoJ has indicated that it intends to put additional scrutiny on “repeat offenders.” Companies that have been subject to multiple Deferred Prosecution Agreements may find that this works against them if they find themselves under investigation again in the future.”

In October, INTERPOL announced the launch of its fully operational Metaverse, initially designed for activities including immersive training courses for forensic investigations. Speaking at the 90th INTERPOL General Assembly in New Delhi, INTERPOL Secretary General Jürgen Stock said the technological advancement would help support “our member countries to fight crime and making the world, virtual or not, safer for those who inhabit it.”

Commenting on the growing intersection between the metaverse and financial crime Alia Mahmud, Regulatory Affairs Specialist at ComplyAdvantage, said, “Financial crimes and cybercrime are invariably linked. As a significant amount of financial fraud and the rise in online child sexual exploitation and abuse take place through digital technologies, cybercriminals depend on financial fraud to launder their illicit gains. With the number of Metaverse users growing and the technology further developing, it is important for law enforcement bodies to experience the Metaverse for themselves.

“Fully operational, the INTERPOL Metaverse allows registered users to tour a virtual copy of the INTERPOL General Secretariat headquarters in Lyon, France, without any geographical or physical boundaries, and interact with other officers via their avatars.”

In November, a criminal known on social media as “Ray Hushpuppi” was sentenced to over 11 years in federal prison for conspiring to launder tens of millions of dollars from online scams. Described by the FBI as “one of the most prolific money launderers in the world,” Ramon Olorunwa Abbas was found guilty of laundering money from various online crimes, including bank cyberheists and business email compromise schemes.

In addition to facilitating these online scams, Abbas laundered funds stolen from a bank in Malta and a professional UK football club. According to court documents, Abbas and his co-conspirator placed the stolen funds through a Mexican bank account that “could handle millions and not block” the deposits.

Iain Armstrong, Regulatory Affairs Specialist at ComplyAdvantage said, “This is the longest known sentence for money laundering handed out to an individual who has a large following on the ‘gram. We don’t expect this record to last very long, though, as the influencer known as “Jay Manzini” recently pled guilty to money laundering charges for, among other things, his role in a huge crypto-based Ponzi scheme. It’s thought that Manzini’s sentence could be as high as 20 years.”

Catch up on some of the most popular news stories we reported on in 2022:

Stay on top of regional trends and novel criminal techniques so you can protect your business from financial crime.A Spotlight on Financial Crime

Originally published 22 December 2022, updated 06 January 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).