In recent months we have undergone a significant undertaking to revise our Adverse Media categorization. We have upgraded from 7 standard categories to 14 precise FATF-aligned categories. This is designed to enable our users to spot risks more effectively and efficiently.

Powered by an upgraded machine learning model, users can now further reduce false positives while improving the rate of true matches for more severe categories of adverse media.

Below we explain what that means and explore the reasons for making this change; here it is in brief:

The Financial Action Task Force (FATF) recommendations state that financial institutions must “understand their client’s reputation”, including previous criminal liabilities like involvement in money laundering investigations. Compliance with that direction requires adverse media screening – which traditionally involves time-consuming manual checks of vast, unsorted amounts of news reports, blog articles, and social media.

Categorizing adverse media, allows firms to prioritize that workload, and gauge the level of risk associated with each client more efficiently. Negative news categorization also better facilitates automated screening, in which searches can be further tailored to client profiles and regulatory environments.

This is particularly effective when using a profile-based adverse media tool which ensures that media is accurately grouped according to individuals and organizations, and enriched with identifiers like the year of birth and country. It allows efficient screening by quickly discounting irrelevant matches based on known customer information – which is in stark contrast to the frustrating experience of sifting through long lists of media with article-based solutions.

At ComplyAdvantage, we’re investing millions of dollars in training data to locate signals in the long tail of media where hidden risks actually exist. This is only possible through machine learning, not via outdated rules-based systems.

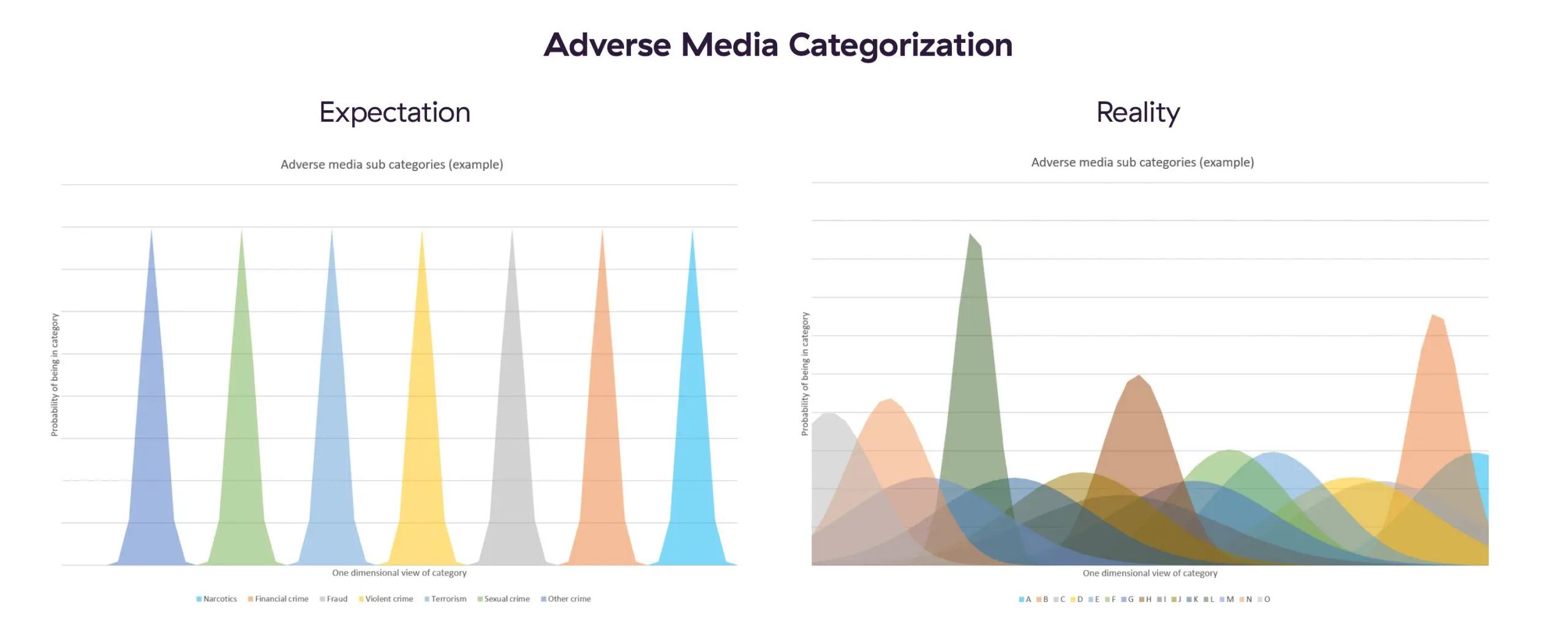

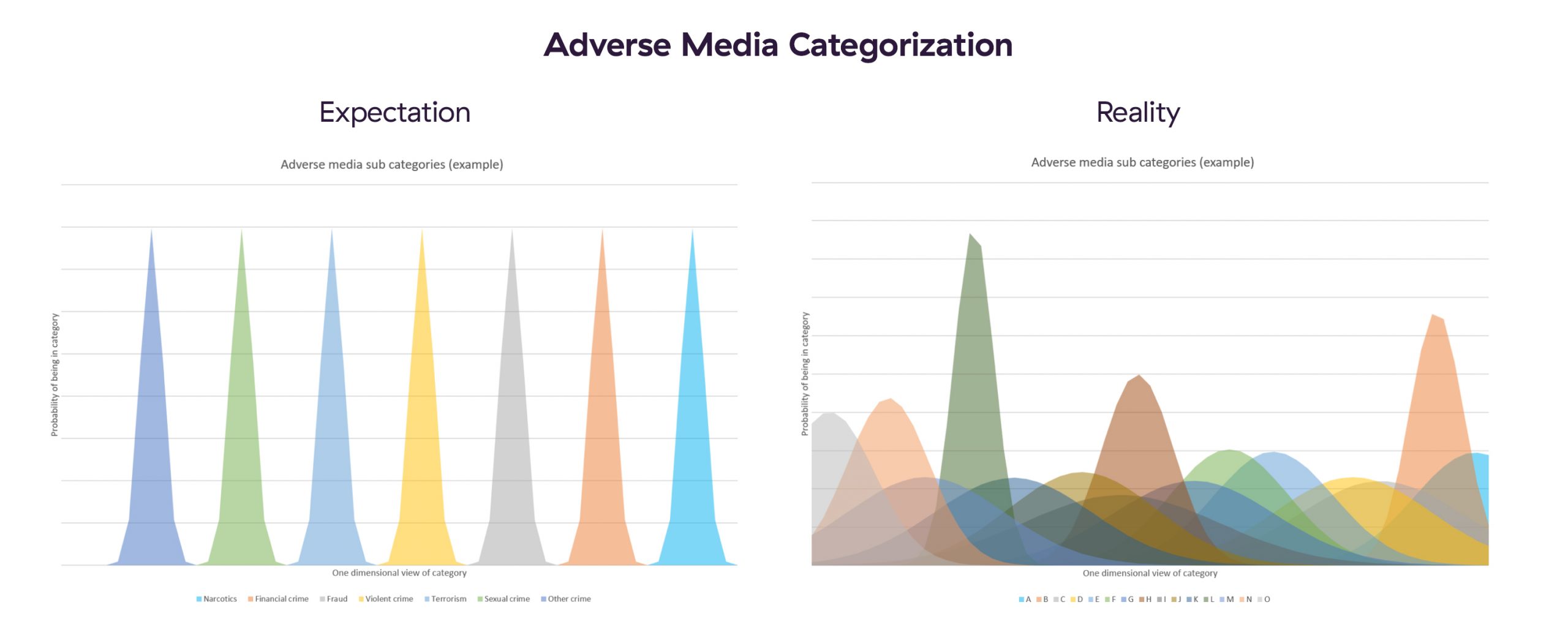

Once adverse media is identified, the next step is to give customers the option to filter out what is not relevant to their business. However, when it comes to adverse media crime types, there are not always clearly defined borders. What constitutes an act of terrorism but not a violent crime, for example?

The recent codification of 22 predicate offenses also changes the tone of the debate, because it places predicate criminality back at the forefront of what AML is about – the detection, disruption, and prevention of crimes that help criminals make money.

To ensure good machine learning classification accuracy, an adequate number of well-labeled categories are required. Too many categories, or categories that are difficult to understand, would result in a higher probability of being misclassified (high false positives & false negatives). Too few categories and the result is correct classification but a high degree of non-relevant media (false positives). Therefore to ensure our customers benefited from as much flexibility and accuracy in their screening as possible, we needed to land on the most optimal compromise point.

To refine our new categories, we spoke to hundreds of ComplyAdvantage customers and subject matter experts to really understand the issues they were facing and what regulated organizations would need to enhance the efficiency of their adverse media screening.

We’ve grouped them as follows:

Depending on their jurisdiction or product line, users need to precisely search and only see customer profiles that contain categories relating to what is deemed as relevant to their business.

All of our adverse media entity profiles are assigned at least one category depending on the type of media they have been associated with, and therefore existing profiles needed to be assigned to the new categories to align search settings and the underlying data.

Settings within our REST API are configurable, meaning customers can change thresholds, search strings, or any other relevant information as required. This gives compliance officers the ability to adapt their screening approach to regulatory changes and business strategy at a moment’s notice.

Want to learn more about how AIM Insight can help your business? Find out how Santander UK cut their customer onboarding cycle time from 12 days to 2 days.

Originally published 26 March 2021, updated 07 September 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2024 IVXS UK Limited (trading as ComplyAdvantage).